From Future Cash Flows to Present Value: Using the DCF Method for Startup Valuation

For startup founders, understanding the true value of your venture is critical. One of the most widely used techniques in financial modeling is the Discounted Cash Flow (DCF) method. This method estimates a startup’s current value based on its projected future cash flows—transforming future potential into today’s value. However, when it comes to early-stage companies, applying DCF can be challenging due to uncertainties in revenue and growth.

How DCF Works for Startups

The DCF method involves several key steps:

- Project Future Cash Flows:

For startups, forecasting future cash flows can be tricky due to volatile revenue streams. However, by examining your business plan, market size, and growth expectations, you can project earnings over a period (typically 5–10 years).

Example for a tech startup, “TechPro”:- Year 1: ₹10,00,000

- Year 2: ₹20,00,000

- Year 3: ₹40,00,000

- Year 4: ₹60,00,000

- Year 5: ₹80,00,000

- Choose a Discount Rate:

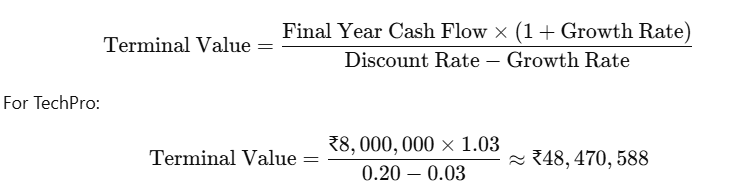

Startups face high risks and uncertainties, so a higher discount rate is used to account for potential volatility. In our example, a 20% discount rate is assumed. - Calculate the Terminal Value:

Since startups are expected to grow rapidly initially and then stabilize, much of the valuation comes from the terminal value. This value captures the company’s worth beyond the forecast period using a steady growth rate (e.g., 3%).

Using the Gordon Growth Model:

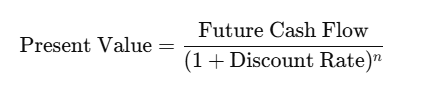

- Discount Future Cash Flows to Present Value:

Each projected cash flow and the terminal value are discounted back to present value using:

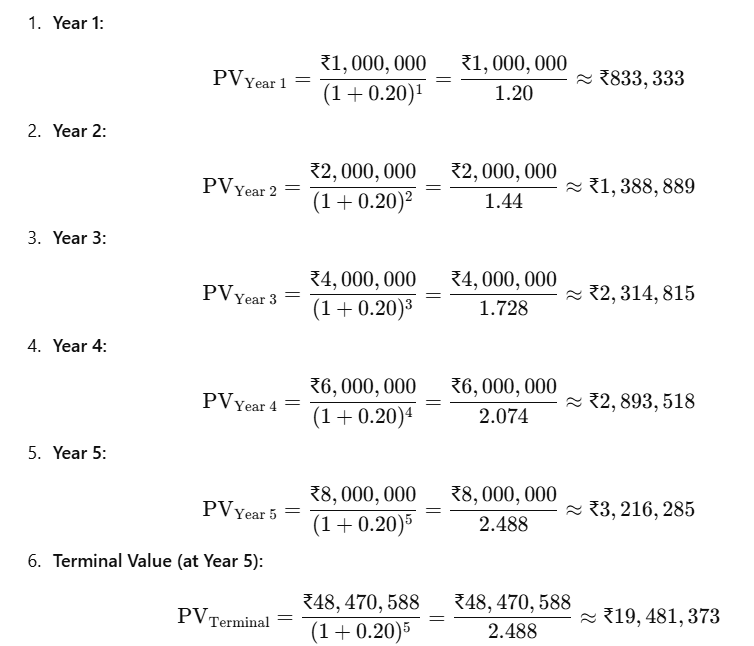

- Detailed Discounting Calculations:

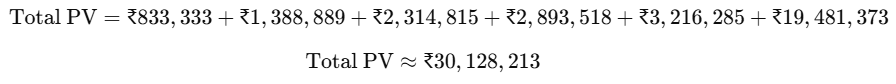

- Sum Up All Present Values:

Adding the present values of individual cash flows and the terminal value provides the total present valuation.

- In our TechPro example, this comes out to approximately ₹30,00,000.

Pros and Cons of the DCF Method

Pros:

- Long-Term Perspective:

DCF focuses on the future potential of the startup. It is particularly useful when you have a clear growth plan, as it incorporates long-term value. - Customizable and Flexible:

The method allows adjustments based on different growth scenarios, risk factors, and market conditions. - Focus on Fundamentals:

It evaluates the intrinsic value by considering actual cash flow generation rather than just market sentiment.

Cons:

- High Uncertainty in Projections:

For early-stage startups, accurately forecasting future cash flows is challenging due to unpredictable revenues and high volatility. - Sensitive to Assumptions:

Small changes in the discount rate or growth projections can significantly affect the valuation. - Heavy Reliance on Terminal Value:

Often, a large portion of the valuation comes from terminal value assumptions, which can be speculative.

When to Use the DCF Method

Best for:

Startups that have reasonable and credible projections of future cash flows. If your business model is clear and your growth plan is well-articulated, DCF can provide a robust valuation framework.

Use it when:

- Your startup has reached a point where revenue projections, even if preliminary, are available.

- You have a clear long-term growth plan and can justify the assumptions used in the projections.

- You want to emphasize the long-term potential and fundamental value of your business rather than short-term market fluctuations.

The Discounted Cash Flow method remains a powerful tool in startup valuation when used correctly. It requires diligent forecasting and thoughtful consideration of risks, but it offers an intrinsic look at what a startup is truly worth today. For startup founders and ecosystem enablers, incorporating DCF into your valuation toolkit can help in making informed decisions, attracting investors, and planning strategic growth.

If your startup can generate credible cash flow projections, DCF is an excellent method to quantify future potential and align your business strategy with long-term objectives.