When it comes to early-stage fundraising, many startups face the challenge of being pre-revenue or having limited financial histories. Traditional valuation methods often fall short, which is why the Revenue Multiplier Method has gained popularity among founders and investors alike. This approach relies on applying a revenue multiple—derived from similar companies—to a startup’s projected revenue, thereby offering a realistic and investor-friendly valuation.

What Is the Revenue Multiplier Method?

The Revenue Multiplier Method determines a startup’s valuation by multiplying its projected revenue for the next year by a multiple that reflects market conditions and comparable startup data. This method is especially useful for startups that have not yet reached profitability but can demonstrate potential through growth projections.

Step-by-Step Approach to the Revenue Multiplier Method

Step 1: Gather Data on Similar Startups

To determine an appropriate revenue multiple, start by collecting valuation data from comparable startups in the same industry and at a similar stage of growth. Key data sources include:

- MCA Portal (for Indian startups): Provides financial and valuation details of private limited companies.

- Crunchbase, Venture Intelligence, Owler, PitchBook, Tracxn: Offer startup funding data, investor details, and financial insights.

- Company Reports & News Articles: Funding announcements that disclose valuations and revenue projections.

- Investor Portfolios & Market Research Reports: These offer benchmarks and additional context.

Criteria for selecting comparables:

- Industry/Domain: Ensure the startups operate in the same sector.

- Business Model: For example, SaaS, e-commerce, D2C, fintech.

- Growth Stage: Pre-seed, Seed, Series A, etc.

- Recent Funding Rounds: Preferably within the last 2–3 years.

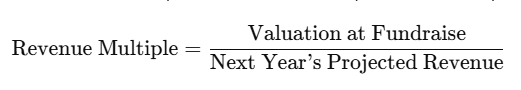

Step 2: Calculate Revenue Multiples for Comparable Startups

Once you have a list of 5–6 similar startups, calculate each startup’s revenue multiple using the formula:

Example Calculation:

| Startup | Valuation (₹ Cr) | Next Year’s Projected Revenue (₹ Cr) | Revenue Multiple |

|---|---|---|---|

| A | 50 | 10 | 5x |

| B | 75 | 15 | 5x |

| C | 90 | 20 | 4.5x |

| D | 120 | 30 | 4x |

| E | 60 | 12 | 5x |

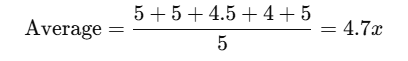

Average Revenue Multiple:

Step 3: Apply the Revenue Multiple to Your Startup’s Projected Revenue

To estimate your startup’s valuation, apply the determined multiple to your own projected revenue for the next year:

Example:

If your startup projects ₹10 crore in revenue next year, using a 4.7x multiple gives:

Step 4: Refinements for Greater Accuracy

- Weighting the Revenue Multiples:

Not all comparable startups are equally relevant. Weight the multiples based on:- Funding stage (Pre-seed vs. Series A)

- Growth trajectory (past revenue CAGR)

- Current market conditions

- Adjusting for Market Trends:

Multiples can fluctuate with the funding climate. Apply a market correction factor if valuations seem inflated during a boom or depressed during a downturn. - Cross-Validation with Other Methods:

For a well-rounded valuation, consider cross-checking your results using:- Venture Capital Method (exit valuation approach)

- Discounted Cash Flow (DCF) (future earnings-based valuation)

- Comparable Transactions Method (valuation based on recent acquisitions)

Pros and Cons of the Revenue Multiplier Method

Pros

- Simplicity and Speed:

Provides a quick, straightforward way to estimate valuation without the need for detailed financial projections. - Benchmarking:

Relies on real market data from similar startups, making it relatable and investor-friendly. - Ideal for Early-Stage Fundraising:

Especially useful for pre-revenue startups that can demonstrate potential through growth projections.

Cons

- Accuracy Depends on Data Quality:

If comparable startups’ data is outdated or not truly comparable, the multiple may be misleading. - Limited to Revenue-Based Metrics:

Does not account for profitability or cash flow nuances. - Market Condition Sensitivity:

Multiples can be volatile, influenced by investor sentiment and market cycles. - Oversimplification:

May overlook unique factors or competitive advantages that could affect a startup’s true value.

When to Use the Revenue Multiplier Method

Best for:

- Early-Stage Startups with Clear Projections:

Ideal for startups that have a reliable revenue forecast, even if they’re not yet profitable. - Fundraising Rounds:

Commonly used during early-stage fundraises (e.g., Pre-seed, Seed, Series A) where investors are focused on growth potential. - Benchmarking Against Comparable Companies:

Works well when there is accessible data from similar startups in the same industry.

When Not to Use:

- Mature or Profitable Companies:

For established companies with stable revenues, other methods like DCF or EBITDA multiples are more appropriate. - Industries with Unique Metrics:

If a startup operates in a niche where revenue does not adequately reflect value, the method may be less reliable. - Lack of Comparable Data:

If there are insufficient similar startups to derive a meaningful multiple, this method might not be appropriate.

What Kind of Startups Can Use This Method?

- Pre-Revenue and Early-Stage Ventures:

Startups that are still building their market presence and have limited financial history. - High-Growth Sectors:

Industries such as tech, SaaS, fintech, and e-commerce where growth projections can be reasonably estimated. - Data-Driven Models:

Startups that can provide clear revenue forecasts based on market research and historical trends.

What Kind of Startups Should Not Use This Method?

- Mature Businesses:

Companies with consistent revenue streams and established profitability should opt for more traditional valuation methods. - Highly Specialized Niches:

Startups in sectors where revenue is not the primary indicator of success or where unique performance metrics apply. - Startups Lacking Reliable Projections:

If the revenue forecasts are highly speculative or based on minimal historical data, the multiplier method may produce misleading results.

The Revenue Multiplier Method is a widely adopted valuation approach during early-stage fundraising. By leveraging market data from comparable startups, it provides a tangible, investor-friendly way to estimate a startup’s value—even in the absence of established profitability. While it comes with its share of limitations, when used appropriately and refined with weighting and market adjustments, it can be a powerful tool for founders and ecosystem enablers.